In the speedy advanced world, organizations should adjust quickly to remain ahead. Innovation is at the center of this advancement, and overseeing assets successfully is urgent to supporting it. In our continuous series on speeding up innovation by shifting left FinOps, we jump into how coordinating monetary activities (FinOps) from the get-go in the improvement cycle can smooth out your tasks and fuel development. In this 6th portion, we will investigate the significance of FinOps, its viable applications, and how it can separate obstructions inside your association.

Understanding FinOps

FinOps, short for Monetary Activities, is the act of carrying monetary responsibility to the cloud’s variable spend model. This approach adjusts designing, tasks, and money groups to cooperate to advance cloud spending and work on monetary straightforwardness. The objective is to guarantee that cloud spending is unsurprising, controllable, and upgraded to meet the association’s goals.

The Need for Shifting Left

Shifting left in FinOps means incorporating financial considerations into the early stages of development rather than waiting until the end of a project or a billing cycle. This proactive approach helps organizations to:

- Identify and mitigate cost overruns early

- Enhance budget forecasting and planning

- Foster a culture of financial responsibility across teams

The Role of FinOps in Accelerating Innovation

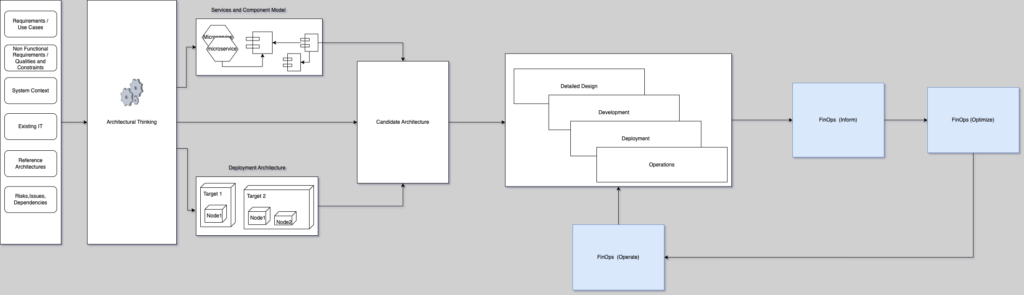

Accelerating innovation by shifting left FinOps involves several key practices that can transform how your organization approaches cloud costs and financial management. Here’s how you can harness the power of FinOps to drive innovation:

1. Embed Financial Accountability Early

Integrating FinOps practices from the start of a project ensures that financial considerations are part of the decision-making process. This shift can be achieved through:

- Early Budget Planning: Define and approve budgets before development begins.

- Cost Awareness: Educate development teams about the financial implications of their decisions.

- Predictive Analytics: Use data to forecast costs and identify potential savings.

2. Create a Centralized FinOps Hub

Establishing a FinOps hub centralizes financial operations and fosters collaboration between engineering and finance teams. This hub acts as the nerve center for:

- Cost Management: Monitor and control cloud expenditures in real-time.

- Cross-Functional Collaboration: Break down silos between different departments.

- Continuous Improvement: Implement best practices and refine financial strategies.

3. Automate and Integrate

Automation plays a crucial role in managing cloud costs effectively. Integrate FinOps with your existing tools and processes to:

- Automate Reporting: Generate financial reports and insights automatically.

- Integrate with CI/CD Pipelines: Embed cost controls into your continuous integration and delivery workflows.

- Implement Cost Controls: Set up policies and alerts to prevent overspending.

Practical Steps to Implement FinOps

To effectively implement accelerating innovation by shifting left FinOps, follow these practical steps:

1. Assess Current Practices

Evaluate your current approach to cloud financial management and identify areas for improvement. Consider:

- Existing Processes: Review how financial decisions are currently made.

- Stakeholder Involvement: Identify who is involved in financial management and their roles.

- Tools and Technology: Assess the tools you use for managing cloud costs.

2. Develop a FinOps Strategy

Create a comprehensive FinOps strategy that aligns with your organization’s goals. Your strategy should include:

- Targets: Characterize clear monetary and functional objectives.

- Arrangements: Lay out approaches for spending plan the board, cost control, and responsibility.

- Measurements: Recognize key execution markers (KPIs) to gauge achievement.

3. Train Your Teams

- Training Programs: Develop programs to educate teams about FinOps principles and practices.

- Workshops and Seminars: Host sessions to discuss financial management and cost optimization.

- Resources: Offer resources and tools to help teams apply FinOps practices effectively.

Comparison of Traditional vs. Shifting Left FinOps

Here’s a comparative overview of traditional FinOps versus accelerating innovation by shifting left FinOps:

| Aspect | Traditional FinOps | Shifting Left FinOps |

|---|

| Timing | End of development cycle | Early in the development cycle |

| Focus | Post-project cost analysis | Proactive cost management |

| Integration | Separate from development processes | Integrated with development workflows |

| Cost Control | Reactive cost control | Predictive and preventive cost control |

| Team Collaboration | Limited interaction between teams | Enhanced collaboration across teams |

FAQs

Q: What does “shifting left” mean in the context of FinOps?

A: “Shifting left” refers to the practice of incorporating financial considerations earlier in the development process, rather than waiting until later stages. This proactive approach helps in better cost management and forecasting.

Q: How does FinOps benefit engineering and finance teams?

A: FinOps aligns engineering and finance teams by fostering collaboration and transparency. It helps both teams understand the financial impact of their decisions, leading to better cost control and budget adherence.

Q: What are some key metrics to track in FinOps?

A: Key metrics include cloud spend, cost per unit of output, budget variance, and cost savings from optimization efforts. Tracking these metrics helps in assessing the effectiveness of FinOps practices.

Q: How can automation improve FinOps processes?

A: Automation can streamline reporting, enforce cost controls, and integrate financial management with existing tools. This reduces manual effort, minimizes errors, and provides real-time insights into spending.

Conclusion

Accelerating innovation by shifting left FinOps is not just a theoretical concept but a practical approach that can drive significant benefits for your organization. By embedding financial accountability early, creating a centralized FinOps hub, and leveraging automation, you can optimize cloud spending, enhance collaboration, and foster a culture of financial responsibility. Implementing these practices will not only streamline your operations but also support sustained innovation and growth.